- What is a 1098-T form?

- When will the 1098-T be mailed?

- To which address is the 1098-T mailed?

- How can I get a second copy of my 1098-T form?

- Detailed Fee Receipt Information and Explanation of the Payments & Charges:

- Steps for accessing the detailed fee receipt information:

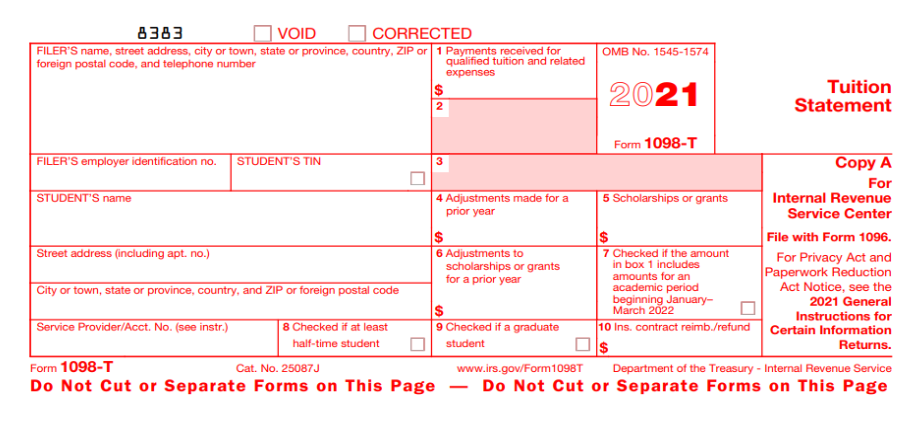

- Information reported on form 1098-T:

- Amounts included in Box 1 are, “Payments received for qualified tuition and related expenses:”

- Amounts included in Box 4 are, “Adjustments made for a prior year:”

- Amounts included in Box 5 are, “Scholarship and grants:”

- Amounts included in Box 6 are, “Adjustments to Scholarships or Grants for a Prior Year:”

- What can you do if you do not receive the 1098-T form?

- 1098-T forms for International Students:

- Can I get help from PVAMU in determining if I am eligible for the educational tax credits?

- Why doesn’t my 1098-T match what I paid/received?

- Can parents/guardians have access to the student’s 1098-T?

- How can I claim the Hope/Lifetime Learning Credit?

The 1098-T is an IRS form entitled “Tuition Statement” that assists the student in determining if he/she qualifies for certain education related tax credits under the Taxpayer Relief Act of 1997(TRA97). The IRS requires eligible educational institutions such as Prairie View A&M University to file a 1098-T form each year for each student (excluding non-resident alien students) enrolled for whom a reportable transaction is made during the calendar year. To find out how and what information Prairie View A&M University reports on the 1098-T form, please click on “Information Reported on Form 1098-T” link above.

The Forms will be mailed by January 31st of the following year. You should receive your 1098-T form within two weeks of this date. This form is also available electronically. Please see “Second Copy of the 1098-T form below or click on the “Second Copy of the 1098-T form” above and follow the instructions.

The 1098-T form will be mailed to the mailing address listed in PantherTracks. If your address has changed recently, please go to PV Place and enter the correct address information inside of PantherTracks.

Second Copy of the 1098-T form:

You can print copies of your 1098-T statements by following the steps below. Please read the instructions carefully:

Step 1: Go to https://tra.maximus.com/

Step 2: Login in using the User ID and Password if you have established a User ID and Password in previous semesters.

Step 3: If you have never accessed the Vangent TRA website, please click the “First Time Students” link to set-up a new account.

Step 4: By clicking this link, you will be taken to a registration page. Please complete all required information and click “Next” to be taken through the account set-up process.

Step 5: If there are 1098-T forms available for you to view, you will be asked to complete the registration process.

Step 6: Once all requested information is entered, click ‘Complete Registration”. If registration is successful, you will receive the message below.

Step 7: An email will be sent to the email address provided with a temporary password. You will then be directed to log into the site with your user ID and temporary password.

Step 8: You will then be prompted to create a new password.

Step 9: Once you log in, you will have to establish a challenge question for account security.

Step 10: Once your security question has been established, you will receive a message that your account has been created.

Step 10: The Student Options screen will appear with all available 1098-T information. Please scroll to the bottom of the list for the most current 1098-T. You can View/Print your 1098-T from the website.

Step 11: If you have previously accessed the site; but, you have forgotten your User ID and/or Password, please click the appropriate link to have Password/ User ID retrieved.

Detailed Fee Receipt Information and Explanation of the Payments and Charges:

Prairie View A&M University posts a detailed break down of payments and the qualified and unqualified charges on the student portal/PantherTracks of the university website (https://pvportal.pvamu.edu/). This detailed information is supplemental and is not reported to the IRS. All financial information that is posted on the web is summarized by type and academic term. In addition to the financial information, explanation of the charges is also provided there.

You can access this information by taking the following steps:

- Log in to PantherTracks at https://pvportal.pvamu.edu/

- Click on “Register for classes, view and pay fees and view financial aid status and tracking documents”

- Click on “Enter Secure Area”

- Enter User ID and Pin and click on “Login”

- Select the term and click “Submit”

- Verify address information and click continue. (If address information is incorrect please click on “correct my address” and update your information.)

- Click on “Student and Financial Aid”

- Click on “Student Account”

- Click on “Select tax year” Enter “2018” for the tax year and click “submit”

- Click on “Tax Notification”. The tax notification information that was reported to the IRS should be displayed. (This information was not reported for International Students. If you are an international student and you are requesting a 1098-T form, please contact Treasury Services at 936-261-1890 or at stuar@pvamu.edu for assistance)

Information reported on form 1098-T:

Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, the University will report in box 1 the amount of QTRE (Qualified Tuition & Related Expenses) you paid during the year. On the 1098-T form, Prairie View A&M University reports student’s name, SSN, address and indicates if the student was a graduate student or at least half-time during the calendar year. The university now reports the amount paid for qualified tuition and related expenses as opposed to previous tax years where the qualified tuition & related expenses were reported for the calendar year. The amount reported in box 1 will for be payments made but only up to the amount of qualified tuition & related expenses billed for the calendar year.

Some Examples of Qualified and Unqualified Charges:

|

Qualified Tuition and Related Expenses |

Unqualified Expenses |

|---|---|

|

|

Amounts included in Box 1 , “Payments received for qualified tuition & related expenses”:

This represents the amounts paid less any refunds received during the calendar year for qualified tuition and related expenses. Payments includes all payments such as personal payments, loans and scholarships with the exception of scholarships that are used specifically for non-qualified expenses such as room & board. The amount reported is the total paid but only up to the amount of qualified tuition & related expenses billed for that calendar tax year. For example, if a student has total payments of $10,000 for the tax year but only has qualified tuition & related expenses billed for $7,000 for the tax year, the amount reported in box 1 will only be $7,000 due to the amount of the qualified tuition & related expenses billed. If a student has qualified tuition & related expenses of $8,000 and payments of $5,000, the amount reported in box 1 will be $5,000 because full payment was not received for the qualified tuition & related expenses during that calendar year. Scholarships and grants are also reported in box 5 including those that pay specifically for non qualified charges.

Amounts included in Box 4 , “Adjustments made for a prior year”:

This represents any reduction in charges made for qualified tuition and related expenses processed during the calendar year that relate to amounts billed that were reported for a prior year.

Amounts included in Box 5 , “Scholarship and grants”:

This represents the total of all scholarships or grants received and processed for the calendar year including those for non-qualified expenses such as meals or housing charges

Amounts included in Box 6 ,“Adjustments to Scholarships or Grants for a Prior Year”:

This represents any reduction to the amount of scholarships or grants that were reports for the prior year.

What to do if you do not receive the 1098-T Form:

Prairie View A&M University sends a 1098-T form to every student with the exception of foreign students that do not have a SSN on file, from whom the university received payment for qualified tuition and related expenses. If you were enrolled at least half time in any semesters during the previous calendar year, did not receive your 1098-T, and it is not available on the TRA Services website www.tra.maximus.com contact the University at 936-261-1890 or at stuar@pvamu.edu.

1098-T forms will be produced for international students with a SSN on file. Those that do not have an SSN on file at the time the University processes 1098-T forms will be processed as requested. Presentation of a valid social security card or tax identification card is required for this purpose. Please contact Treasury Services at 936-261-1890 or at stuar@pvamu.edu for more information.

Determining the eligibility for the educational tax credits:

Prairie View A&M University cannot determine if you qualify for a tax credit and is not allowed to give you tax advice. Please read the instructions on the 1098-T statement and obtain IRS publication 970 and Form 8863 or contact a tax professional about your personal income tax situation. The IRS website for the above form and publication is www.irs.gov/formspubs/index.html, and the IRS can be reached at 1-800-829-1040.

Why doesn’t my 1098-T match what I paid/received?

This is the most common misunderstanding each year. For 1098-T purposes for tax year 2018 and after, Prairie View A&M University reports payment transactions in the calendar year for qualified tuition & related expenses billed for that calendar year. The payments reported will only be reported up to the amount of the qualified tuition & fee charges. For example, if a student has total payments of $10,000 for the tax year but only has qualified tuition & related expenses billed for $7,000 for the tax year, the amount reported in box 1 will only be $7,000 due to the amount of the qualified tuition & related expenses billed. If a student has qualified tuition & related expenses of $8,000 and payments of $5,000, the amount reported in box 1 will be $5,000 because full payment was not received for the qualified tuition & related expenses during that calendar year.

Amounts of qualified tuition and required fees are defined by the IRS as “tuition and fees required for enrollment or attendance at an eligible educational institution”. The IRS does not consider student health fees, transportation fees, recreational sports fees, insurance fees, or room and board of any kind* as qualified tuition and related fees, therefore, these fees are excluded from amounts calculated for payments reported on the 1098-T.

Amounts of scholarships reported on your 1098-T are for determining eligibility for the Hope credit and lifetime learning credit only, NOT for determining taxability of such scholarships. Your scholarships may or may not be taxable, refer to IRS Publication 970 http://www.irs.gov/pub/irs-pdf/p970.pdf for details on determining the taxability of different types of scholarships.

Can Parent/Guardian have access to student’s 1089-T?

Yes, but only with the student’s direct consent and permission. Prairie View A&M University is prohibited from discussing or disclosing any student information over the telephone or to anyone other than the student themselves. Only the student can grant a parent or guardian access to their online 1098-T by logging in for them at www.tra.maximus.com/.

How can I claim the Hope/Lifetime Learning Credit?

IRS Publication 970 has information on how to figure the Hope or Lifetime Learning Credit.